CalSavers vs. 401k

COVID-19 Message: We are here for you.

Due to the shelter in place mandate, the state of California has pushed the registration deadline for employers with more than 100 employees to September 30, 2020. We are here to support you throughout this difficult time.

Once September comes, you need to be ready to either use the CalSavers program, or find a better fitting plan for your company. I am here as an advisor and a resource.

CalSavers vs. 401k – Reviewing the Investment Options for CalSavers and Penalties for No Action

Comparing the CalSavers Retirement Savings Plan to a 401(k) or Pension Plan

CalSavers Overview

As highlighted on our CalSavers notice, the state of California has adoption the California Savers Retirement Savings Plan, “CalSavers”.

Starting as soon as June 2020, California now requires employers who don’t already offer a qualifying employer-sponsored retirement plan, such as 401(k), 403(b), Pension Plan, SEP or SIMPLE Plan to start offering the CalSavers program.

The program rolls out in a three-phase registration deadline, starting as early as next year, mandated with penalties for non-compliance.

CalSavers is an individual ROTH IRA (Individual Retirement Account) option that must be offered by businesses with 5 or more employees.

All contributions are entered as a non-deductible Roth IRA.

All employees, age 18 and over, are immediately eligible to participate.

There are no eligibility requirements based on hours worked after the employee has completed a least 30 days of service. 2

CalSavers currently offers five investment options3:

- Money Market Fund

- Target Date Series

- One ESG Fund

- One Bond Fund

- Two Stock Funds

Asset based fees range from 0.825% to 0.95

CalSaver Penalty for No Enrollment

A lot of employers want to know:

Are there penalties for not enrolling into CalSavers?

Short Answer: Yes. 4

As posted on the CalSavers website:

Each eligible employer that, without good cause, fails to allow its eligible employees to participate in CalSavers, on or before 90 days after service of notice of its failure to comply, shall pay a penalty of $250 per eligible employee if noncompliance extends 90 days or more after the notice, and if found to be in noncompliance 180 days or more after the notice, an additional penalty of $500 per eligible employee.

So, if an employer with 101 employees who does not enroll by the June 2020 deadline receives a notice and does not take action with 3 months, they could be fined as much as $25,250. If they wait another three months from then, that fine could increase to a total of $50,500.

How to avoid CalSavers requirements

The foremost way for a business to avoid having to offer a state-run plan is by offering a qualifying employer-sponsored retirement plan, such as 401(k), 403(b), Pension Plan, SEP or SIMPLE Plan .

Among many reasons to consider a 401k over the CalSavers plan is to allow the most valued employees to benefit.

Because CalSavers accounts are Roth IRA’s, the accounts are subject to federal Roth IRA contribution limits:

Contribution limits based on Modified Adjusted Gross Income6 | ||

Year | Single Filer | Married/Joint Filer |

2019 | $122,000 - $137,000 | $193,000 - $203,000 |

2020 | $124,000 - $139,000 | $196,000 - $206,000 |

How much can I contribute to a 401k or IRA in 2020?

High income earners who pass the phase-out limit will not be able to contribute to the CalSavers program.

Even if an employer or key highly compensated employees are ineligible to contribute to the Roth IRA, the employer is still required to offer the CalSavers plan to all eligible employees (unless the employer offers a qualifying employer sponsored plan).

As we know it in today’s tax laws:

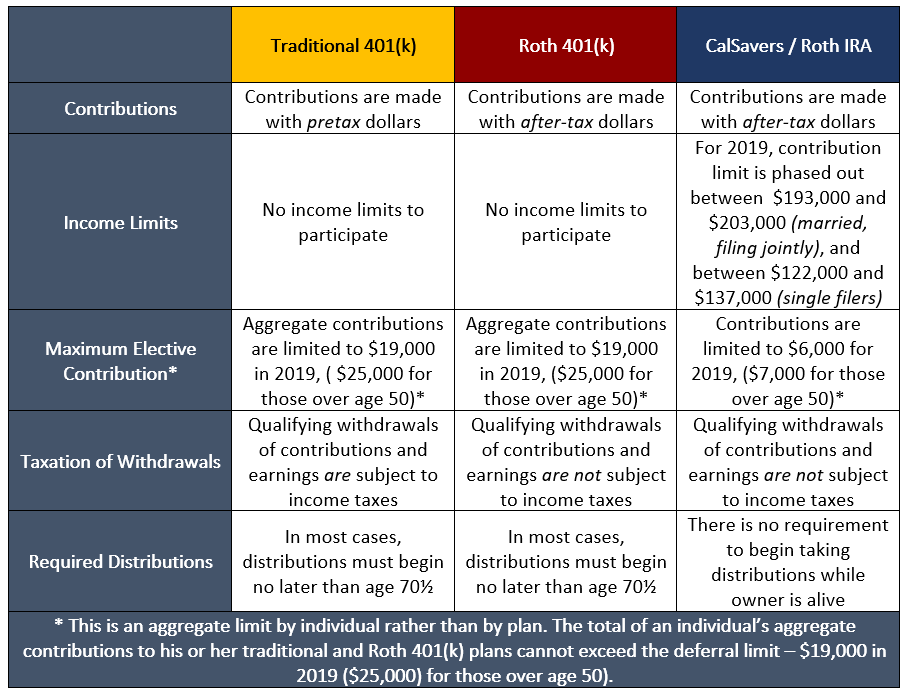

Comparing CalSavers to a 401k

As experts, let us help you understand your options and pick which program would be right for you.

This outline is for informational purposes only and has not provided legal or tax advice.

Employers should consider consulting with their tax, business and legal advisors before adopting either the CalSaver plan or an Employer Sponsored 401(k).

For more detailed information on CalSavers, visit www.calsavers.com.

References:

- CalSavers.com / Employer / Program Details

- CalSavers.com / Employee / Investments

- CalSavers.com / About / FAQ

- CalSavers.com / FAQ / Employer Registration

- CalSavers.com / Savers / Contributions

- IWMFinancial.com / Blog / How much can I contribute to a 401k or IRA in 2020?

- IWMFinancial.com / Resource / What is a Roth 401(k)?